Tax Assessment Write For Us

Tax Assessment Write For Us- Tax assessment is the process of determining the amount of tax that a taxpayer owes. It is done by reviewing the taxpayer’s Income and expenses and applying the applicable tax laws. The taxpayer or a tax professional can perform tax assessments.

The Tax Assessment Process Typically Involves The Following Steps

- Information gathering: The taxpayer or tax professional will gather all the relevant information, such as the taxpayer’s Income and expenses, tax credits and deductions, and filing status.

- Tax calculation: The taxpayer or tax professional will then use the applicable tax laws to calculate the taxpayer’s tax liability.

- Tax return preparation: The taxpayer or tax professional will then prepare a tax return, which is a document that reports the taxpayer’s Income, expenses, and tax liability.

- Tax return filing: The taxpayer will then file the tax return with the appropriate tax authority.

- Tax assessment: The tax authority will then review the tax return and assess the taxpayer’s tax liability.

If the taxpayer agrees with the tax assessment, they will pay it. If the taxpayer disagrees with the tax assessment, they can file a protest.

Tax assessments can be complex, and it is important to understand the tax laws before filing a tax return. Consult a tax professional if you have any questions about the tax assessment process.

Here Are Some Examples Of Tax Assessments:

- Income tax assessment

- Sales tax assessment

- Property tax assessment

- Estate tax assessment

- Gift tax assessment

Tax assessments are an important part of the tax system, and they help to ensure that taxpayers pay their fair share of taxes.

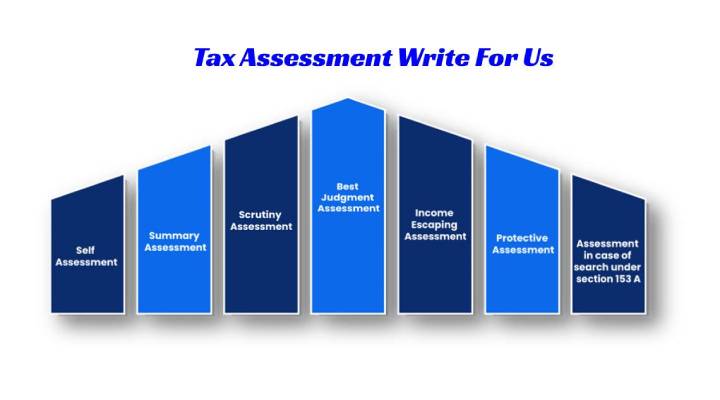

The Different Types Of Tax Assessments

- Self-assessment is the most common type of tax assessment, where the taxpayer calculates their tax liability and files a tax return.

- Summary assessment: The tax authorities carry out This type of assessment without human intervention. It use for simple cases, such as when taxpayers have a small income and no complex deductions.

- Scrutiny assessment: This type of assessment fulfil by the tax authorities reviewing the taxpayer’s tax return in detail and asking for supporting documentation. It uses for complex cases, such as when taxpayers have a lot of Income or complex deductions.

- Best judgment assessment: This type of assessment is fulfill by the tax authorities, who estimate the taxpayer’s tax liability if they do not file a tax return or do not provide adequate information.

- Income escaping assessment: This type of Income escaping assessment is carried out by the tax authorities, who assess income tax that has escaped assessment in previous years.

There Are Also Some Specialized Tax Assessments,

- Transfer pricing assessment: This type of assessment is carried out by the tax authorities, who review the pricing of transactions between connected companies to ensure that they are fair and at arm’s length.

- International tax assessment: This type of assessment fulfill by the tax authorities, who review the tax affairs of taxpayers with global operations.

- Indirect tax assessment: This assessment is carried out by the tax authorities, who assess taxes such as value-added tax (VAT) and goods and services tax (GST).

- Customs assessment: The customs authorities carry out This type of assessment, assessing taxes and duties on imported and exported goods.

The type of tax assessment will depend on the taxpayer’s circumstances and the tax rate.

How to Submit Your Articles?

To submit guest posts, please study through the guidelines mentioned below. You can contact us finished the website contact form or at contact@marketing2business.com

Why Write for Marketing2Business – Tax Assessment Write For Us

- If you write to us, your business is targeted, and the consumer can read your article; you can have huge exposure.

- This will help in building relationships with your beleaguered audience.

- If you write for us, the obvious of your brand and contain worldly.

- Our presence is also on social media, and we share your article on social channels.

- You container link back to your website in the article, which stocks SEO value with your website.

Search Terms Related to Tax Assessment Write for Us

- Tax audit

- Tax notice

- Tax penalty

- Tax interest

- Tax refund

- Tax credit

- Tax deduction

- Tax form

- Tax return

- Tax preparer

- Tax lawyer

- Tax accountant

- Tax software

- Tax year

- Tax period

- Tax base

- Tax rate

- Taxable income

- Non-taxable income

- Taxable event

- Tax liability

- Tax avoidance

- Tax evasion

Search Terms for Tax Assessment Write For Us

- Tax Assessment Write for us

- Guest Post Tax Assessment

- Contribute Tax Assessment

- Tax Assessment Submit post

- Submit an article on Tax Assessment

- Become a guest blogger at Tax Assessment

- Tax Assessment writers wanted

- Suggest a post on Tax Assessment

- Tax Assessment guest author

Article Guidelines on Marketing2Business – Tax Assessment Write For Us

- The author cannot be republished their guest post content on any other website.

- Your article or post should be unique, not copied or published anywhere on another website.

- The author cannot be republished their guest post content on any other website.

- You cannot add any affiliates code, advertisements, or referral links are not allowed to add into articles.

- High-quality articles will be published, and poor-quality papers will be rejected.

- An article must be more than 350 words.

- You can send your article to contact@marketing2business.com