The Importance of Credit Card Bonuses: Understand the Terms

Credit cards can be a powerful financial tool when used wisely. They help build credit, offer convenience, and sometimes come with great perks. One of the biggest attractions for new users today is credit card bonuses. But here’s the thing — while these bonuses look exciting on paper, it’s crucial to understand the terms and conditions before signing up.

In this article, let’s break down why credit card bonuses matter, how they work, and what you need to know before chasing one.

What Are Credit Card Bonuses?

A Quick Overview

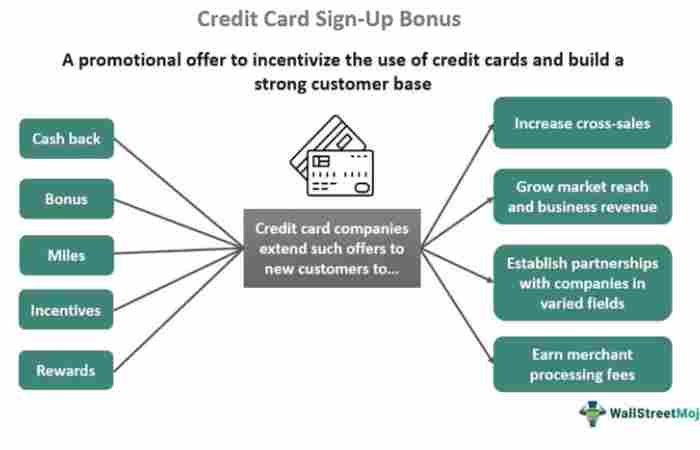

Credit card bonuses are rewards offered by card issuers to attract new customers. These bonuses can come in the form of:

-

Cashback

-

Reward points

-

Travel miles

-

Statement credits

-

Gift cards

Typically, you get the bonus after meeting a minimum spending requirement within a set period — like spending $3,000 in the first 90 days.

Why Banks Offer Them

Banks use bonuses to bring in new users and encourage spending. The more you use the card, the more transaction fees they earn. It’s a win-win if you manage your payments wisely — but risky if you spend more just to earn a bonus.

The Importance of Credit Card Bonuses

1. Extra Value for New Users

A good bonus can provide immediate value. For example:

-

A $200 cashback on $1,000 in spending is a 20% return right away.

-

A 60,000-mile travel bonus could cover an international flight.

That’s a significant gain, especially if you already planned to make those purchases.

2. Helps Maximize Everyday Spending

Credit card bonuses encourage smarter use of your cards. When paired with ongoing rewards programs — like 2% cashback on groceries or 3x points on travel — you get even more value from everyday expenses.

3. Can Boost Travel and Lifestyle Perks

Some premium cards offer sign-up bonuses that include:

-

Free hotel stays

-

Airline upgrades

-

Airport lounge access

-

Travel insurance

If you travel often, these bonuses can save you hundreds of dollars annually.

4. Builds a Foundation for Credit

When managed well, a new credit card (with a bonus) can help build your credit history. Paying off your balance on time shows lenders that you’re reliable, which improves your credit score over time.

The Hidden Side: Terms You Must Understand

Credit card bonuses come with fine print — and missing it can cost you. Let’s break down the most common terms that every smart cardholder should understand before applying.

1. Minimum Spending Requirement

How It Works

Most cards require you to spend a certain amount within a specific timeframe to earn the bonus.

Example: Spend $3,000 in the first 90 days to earn 50,000 points.

Why It Matters

If you don’t meet the spending requirement in time, you lose the bonus entirely — even if you were just a few dollars short.

Pro Tip:

Only apply if your regular spending can comfortably meet that requirement without forcing extra purchases.

2. Eligible Purchases

What Counts (and What Doesn’t)

Not every purchase counts toward the bonus. Common ineligible transactions include:

-

Balance transfers

-

Cash advances

-

Fees and interest charges

-

Gift card purchases (in some cases)

Always read the issuer’s terms to know what qualifies as an “eligible purchase.”

3. Time Frame

The Clock Starts Immediately

The countdown for meeting the spending requirement usually starts from your account approval date, not when you receive or activate the card.

If you wait too long to use your new card, you might run out of time. Track your spending closely using the issuer’s mobile app or statements.

4. Annual Fees

Understanding the Trade-Off

Some credit cards charge annual fees — sometimes $95, $250, or even more.

Before applying, calculate whether the bonus outweighs the cost of the annual fee.

Example:

If you earn a $300 bonus but pay a $95 annual fee, your net gain is only $205. It’s still a good deal, but only if you also use the ongoing perks.

5. Reward Redemption Options

Cashback vs. Travel Points

Bonuses can be more or less valuable depending on how you redeem them.

For instance:

-

Cashback gives you a fixed return — simple and straightforward.

-

Travel points may offer higher value if used strategically for flights or hotels.

-

Gift cards or merchandise often provide less value per point.

Always check the redemption value per point or mile before applying.

6. Foreign Transaction Fees

If you travel internationally, look for cards with no foreign transaction fees.

Some cards offer big bonuses but charge up to 3% extra on overseas purchases — which can eat into your rewards fast.

7. Bonus Expiration Dates

Some cards require you to redeem rewards or use them before they expire.

Make sure you know:

-

When your points expire.

-

Whether inactivity causes loss of points.

-

If bonuses convert automatically to statement credits or need manual redemption.

8. Credit Score Impact

New Applications Affect Credit

Applying for a new credit card triggers a hard inquiry, which may temporarily lower your credit score by a few points.

Long-Term Impact

If you open multiple cards in a short period just for bonuses, lenders might view you as a riskier borrower. It’s smart to space out applications and only go for bonuses that truly benefit you.

9. Taxes and Reporting

While rare, some cash bonuses may be considered taxable income (especially if they come from a bank account offer).

Credit card rewards from spending are typically not taxable, but it’s worth double-checking if you’re receiving statement credits or other cash-equivalent rewards.

10. Spending Traps

The Biggest Mistake

Many people fall into the trap of overspending just to earn a bonus. This defeats the purpose, especially if it leads to carrying a balance and paying interest.

Credit card interest rates (APR) can range from 20–30%, which can easily wipe out the value of any bonus you earn.

Rule of Thumb:

If you can’t pay off the balance in full each month, skip the bonus — it’s not worth the debt.

How to Maximize Credit Card Bonuses Wisely

1. Plan Large Purchases Strategically

If you have upcoming expenses (like furniture, travel, or insurance payments), time your card application around those purchases to easily meet spending requirements.

2. Combine Everyday Spending

Use your new card for:

-

Groceries

-

Utilities

-

Gas

-

Subscriptions

These regular expenses help you hit your target without overspending.

3. Track Your Progress

Set reminders or use apps like Mint or YNAB to track how much you’ve spent toward your bonus. Many banks also provide bonus progress meters in their mobile apps.

4. Pay on Time, Every Time

A late payment can cause you to forfeit your bonus entirely. Always pay at least the minimum due — though ideally, you should pay the full balance to avoid interest.

5. Don’t Chase Every Bonus

Be selective. Choose cards that align with your goals — whether that’s cashback, travel, or rewards. Chasing every offer can hurt your credit and create financial stress.

Examples of Common Credit Card Bonus Offers

| Type of Card | Typical Bonus | Minimum Spend | Time Frame |

|---|---|---|---|

| Cash Back Card | $200 cashback | $1,000 | 3 months |

| Travel Rewards Card | 60,000 miles | $3,000 | 3 months |

| Business Card | $500 cashback | $5,000 | 3 months |

| Premium Travel Card | 80,000 points | $4,000 | 3 months |

These offers look tempting — but the real value depends on your spending habits and how you redeem rewards.

When Credit Card Bonuses Are Worth It

Credit card bonuses make sense when:

-

You have planned expenses that meet the spending requirement.

-

You can pay off the balance in full each month.

-

The bonus value exceeds any annual fee.

-

You actually use the ongoing rewards and perks.

They’re not worth it if you’re likely to overspend, miss payments, or pay high interest.

Final Thoughts

Credit card bonuses can be a fantastic way to earn extra rewards, especially if you’re disciplined with your finances. But remember — the key is to understand the terms before you apply.

Pay attention to spending requirements, eligible purchases, fees, and expiration rules. If used strategically, a well-chosen card can offer hundreds of dollars in value, free travel, and long-term credit benefits.

So next time you’re tempted by that “$500 sign-up bonus” ad, take a moment to read the fine print. When you understand the terms, you’ll truly appreciate the importance of credit card bonuses and use them to your advantage.