The Goods and Services Tax (GST) has become an integral part of India’s taxation system since its implementation in July 2017. Whether you’re a business owner, accountant, or consumer, understanding how to calculate GST accurately is essential. That’s where a GST calculator comes in. This tool simplifies tax calculations, ensures accuracy, and saves valuable time.

In this comprehensive guide, we’ll explain what a GST calculator is, how it works, why it’s important, and how you can use it effectively to streamline your tax processes.

What is a GST Calculator?

A GST Calculator is an online or app-based tool that helps individuals and businesses calculate the Goods and Services Tax payable for a specific transaction. It can determine:

- The GST amount is based on the applicable rate.

- The total price is inclusive or exclusive of GST.

- Tax breakup for CGST (Central GST), SGST (State GST), or IGST (Integrated GST).

The calculator applies GST rates as per government norms (commonly 5%, 12%, 18%, or 28%) and instantly shows accurate results.

Why Do You Need a GST Calculator?

GST calculations can be tricky, especially for businesses dealing with multiple products or services at different tax rates. A GST calculator helps in:

- Saving Time—No manual calculations required.

- Avoiding Errors—Ensures accurate tax computation.

- Compliance – Keeps calculations aligned with GST rules.

- Business Transparency—Clear tax breakdown for invoices.

- Financial Planning – Helps businesses project GST liabilities.

Types of GST in India

Before using a GST calculator, it’s important to understand the three main types of GST in India:

1. CGST (Central Goods and Services Tax)

Collected by the central government on intra-state transactions.

2. SGST (State Goods and Services Tax)

Collected by the state government on intra-state transactions.

3. IGST (Integrated Goods and Services Tax)

Collected by the central government on inter-state transactions and imports.

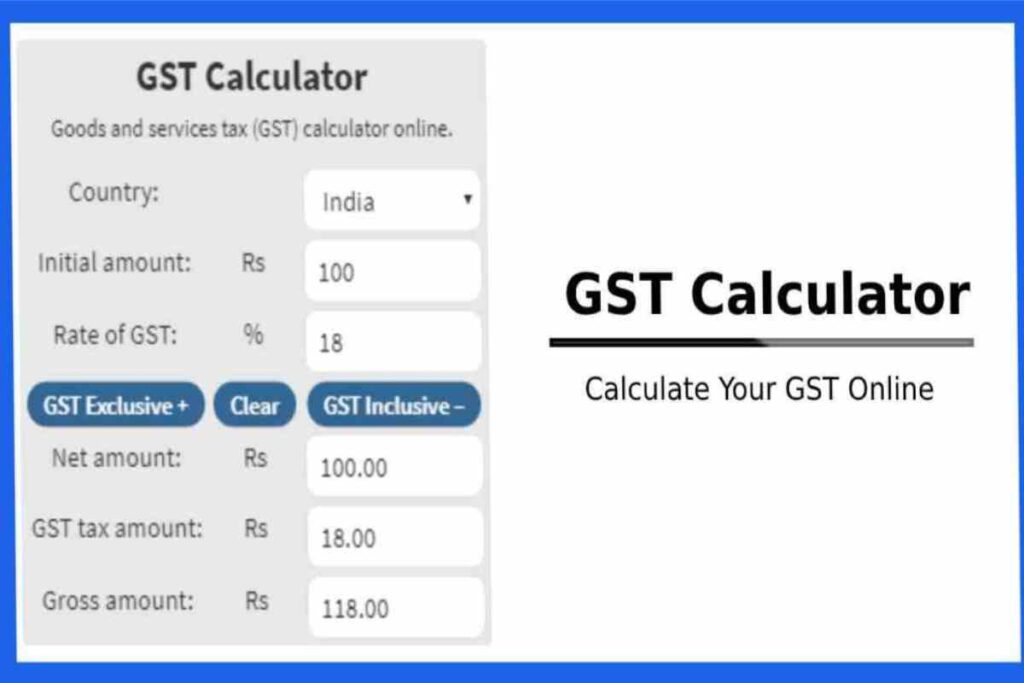

How Does a GST Calculator Work?

A GST Calculator uses a simple mathematical formula to determine the tax amount and the total cost.

GST Calculation Formula

To Add GST to a Base Price:

javaCopyEditGST Amount = (Original Price × GST Rate) / 100 Net Price = Original Price + GST Amount

To Remove GST from a Total Price:

javaCopyEditOriginal Price = Total Price × (100 / (100 + GST Rate)) GST Amount = Total Price − Original Price

By applying these formulas, the calculator instantly provides the GST amount and final price.

Steps to Use a GST Calculator

Using a GST calculator is straightforward:

- Select GST Type – CGST+SGST for intra-state or IGST for inter-state transactions.

- Enter the Amount – Input the price before or after GST.

- Choose GST Rate – Common rates are 5%, 12%, 18%, and 28%.

- Get Results – The tool displays GST amount, total price, and tax breakup.

Example of GST Calculation

Let’s take an example:

- Base Price: ₹1,000

- GST Rate: 18%

GST Amount = (1000 × 18) / 100 = ₹180

Net Price = ₹1,000 + ₹180 = ₹1,180

If the price is GST-inclusive:

- Original Price = 1180 × (100 / 118) = ₹1,000

- GST Amount = ₹1,180 − ₹1,000 = ₹180

Key Features of a Good GST Calculator

When choosing a GST calculator, look for the following features:

- Multiple GST Rate Options – Ability to select various tax rates.

- Inclusive/Exclusive Calculations – Handles both GST-inclusive and GST-exclusive prices.

- Breakdown of CGST, SGST, and IGST – For clarity in invoices.

- Mobile and Desktop Friendly – Easy access anytime.

- Accurate and Updated Rates – Matches government-prescribed GST rates.

Benefits of Using a GST Calculator

A GST calculator offers numerous advantages, especially for businesses:

- Time Efficiency – Instant results without manual effort.

- Error Reduction – Eliminates calculation mistakes.

- Customer Transparency – Shows clear tax amounts on bills.

- Compliance – Keeps tax calculations aligned with GST law.

- Multiple Use Cases – Useful for invoices, quotations, and financial reports.

Who Should Use a GST Calculator?

A GST calculator can be beneficial for:

- Business Owners – For accurate billing and invoicing.

- Accountants – For fast and error-free tax calculations.

- E-commerce Sellers – To set product prices inclusive of GST.

- Consumers – To verify the tax charged on goods and services.

Common GST Rates in India

As of 2025, the standard GST rates applicable to different goods and services are:

- 5% GST – Essential items and services.

- 12% GST – Standard goods and services.

- 18% GST – Most goods and services.

- 28% GST – Luxury goods and sin products.

Online GST Calculators You Can Use

Here are some reliable GST calculator tools available online:

- ClearTax – User-friendly interface with accurate results.

- Tally GST – Ideal for businesses using Tally software.

- BankBazaar [GST Calculator] – Quick and easy tax computations.

- Goodreturns [GST Calculator] – Simple for everyday use.

Future of GST Calculators

With advancing technology, GST calculators are evolving. Future tools may include:

- AI-based Tax Predictions – Automated tax projections.

- Integration with Accounting Software – Direct link with billing systems.

- Mobile App Enhancements – Offline GST calculation features.

- Multi-Language Support – To cater to regional businesses.

Conclusion

A GST Calculator is an essential tool for anyone involved in buying, selling, or accounting for goods and services in India. It not only ensures accuracy and compliance but also saves valuable time. Whether you’re a small business owner or a large enterprise, using a GST calculator can simplify tax processes, reduce errors, and maintain transparency with customers.

With India’s GST framework constantly evolving, having a reliable GST calculator by your side ensures you stay on top of your tax obligations without stress.