Customer Acquisition Cost Definition

The Customer Acquisition Cost (CAC) is the set of investments made to convince a Lead to become a customer.

Indications and networking. These used to be the two primary sources of clients for marketing companies. Happy customers indicating another customer and contact made at an event or course are excellent sources.

Have you already put on paper how much you would be willing to pay for a new client? The problem of not knowing how much we are spending on prospecting is not also knowing if that client is worth it.

And that can be dangerous for your business. The result can be a company full of customers, you exhausted, and accounts are almost always static or negative.

What is Acquisition Cost?

It is an essential financial concept for the health of a company and fully applicable to the business model of service providers, such as marketing agencies and consultancies.

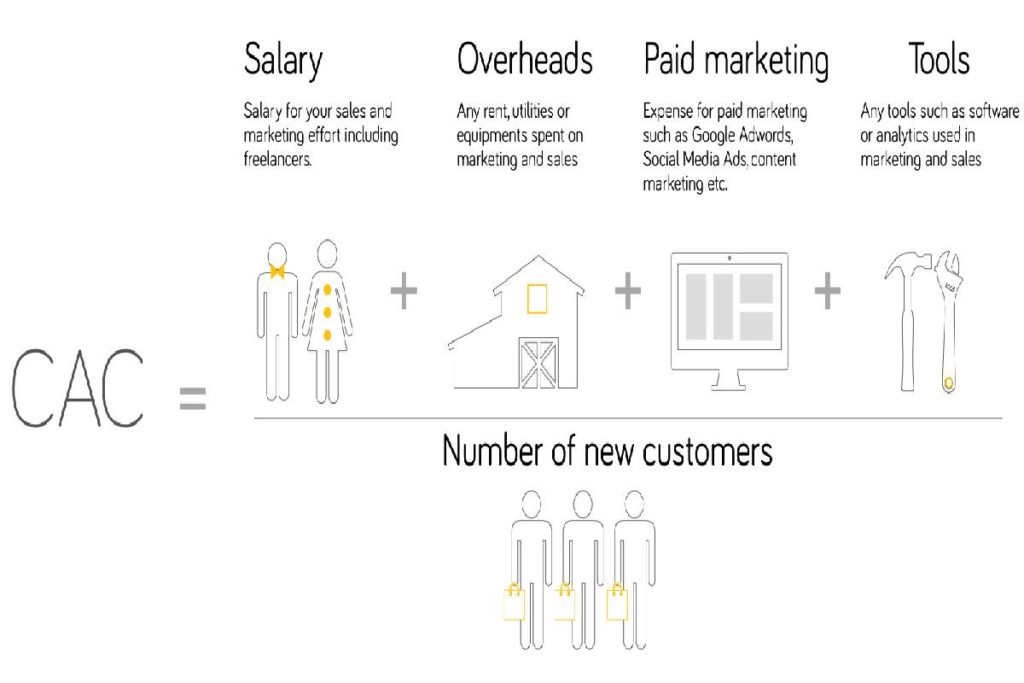

And also, By defining a specific period for analysis, such as a particular month or year, the CAC can be calculated simply:

CAC = (everything invested in marketing + everything invested in sales) / number of clients conquered

Marketing, sales, search, all these expenses are added in this calculation. To give you a clearer idea, in an agency we could list the following expenses:

- Manager hours in negotiation and initial meetings.

- Transfer hours for meetings.

- Hours of an analyst making the diagnosis.

- Telephone costs.

- And also, Structure cost.

- Sponsored link campaigns.

- Participation in associations, fairs, and events for prospecting.

Lifetime value (LTV) – life cycle value

The Lifetime Value of the client refers to all the value granted by the client during the relationship with the company.

- Investment in project

- Monthly fee

- Network and Media Commission

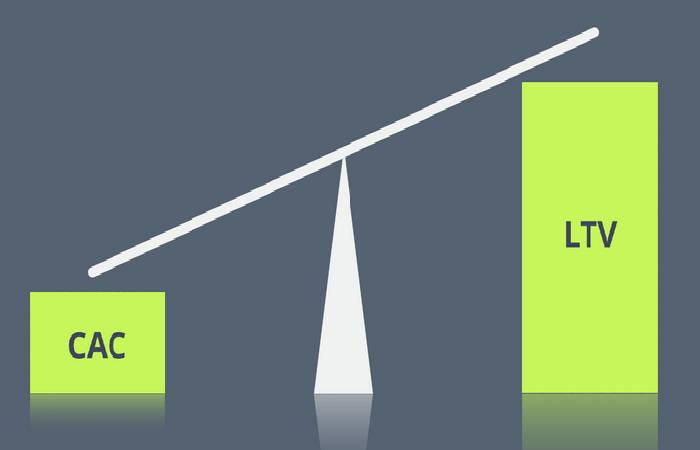

- Commission on production

So with those two metrics, you create a balance. How much have you spent to acquire a customer, and how much will you spend when you become a customer. Our goal is to have the lowest possible CAC and the highest possible LTV.

ROI – Return on investment

This metric will show the balance, positive or negative, that investment had. Yes! Searching for a new customer is an investment, and ROI should evaluate like any other investment. So:

ROI = Billing generated – (investment + operating cost)

In the operating cost, we include the acquisition cost.

How to get a positive balance?

The goal of always keeping the low cost of acquiring new clients should be a command in any agency. What you can do as a manager to increase the Lifetime Value and decrease the Acquisition Cost (green arrows):

To increase the Lifetime Value:

- Keep the customer active and satisfied, so they don’t stop billing for you.

- Find clients who spend recurrently (instead of specific projects).

- And also, Sell other services to your current clients.

- Readjust your values according to the market.

To decrease the acquisition cost:

- Structure an Inbound Marketing and Inbound Sales strategy.

- Adopt the sales and meeting model remotely, via Skype and Hangouts ( Inside Sales ).

- And also, Create some viral Marketing actions.

- Look for strategic partners that could indicate you in exchange for some benefit or commission.

- Stop traveling far in the early stages of prospecting.

Also Read: What is AdEspresso? – Definition, Design, Tips, and More